Unlocking location-based deals on everything from coffee to running shoes has been part of the social media vernacular for a number of years. After all, offering up your location data to retailers and allow companies to pitch you discounts and specials was how many companies aimed to become profitable. Yet only 4% of Americans used any sort of check-in service in 2010.

Unlocking location-based deals on everything from coffee to running shoes has been part of the social media vernacular for a number of years. After all, offering up your location data to retailers and allow companies to pitch you discounts and specials was how many companies aimed to become profitable. Yet only 4% of Americans used any sort of check-in service in 2010.

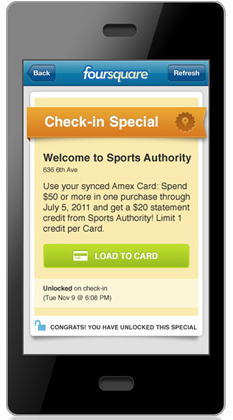

Today, American Express announced a partnership with Foursquare wherein users are able to sync their credit card with location-based app: allowing access to more 'exclusive' discounts and deals for cardholders. AmEx is betting the the consumer may be enticed by the seamless way discounts will be applied to the credit card statements.

What happens when the merchants who provide you deals already have your credit card information? The hope is that it creates less buyer hesitation and leads to an increase in sales. Companies such as LivingSocial make buying daily lunch deals incredibly easy because their mobile apps contain all of your payment information (from that time you bought yoga lessons for 75% off). Meanwhile, all you have to do to buy a Frappuchino is show the barista a barcode on your phone.

The nationwide aspect of this campaign could be big things for the legitimization and mainstream acceptance of location-based apps. After all – if all you had to do to save $20 at Sports Authority was download an app, wouldn't you do it?

The AmEx deal, unlike an app such as LivingSocial or Starbucks means that while your credit card information is stored with foursquare, you still need to physically take out your card when you pay. From a financial security perspective – this makes more sense. Considering that if i lost my phone, someone could unlock it and spend the entire balance of my Starbucks card or change up hundreds of dollars in LivingSocial deals.

Image from https://sync.americanexpress.com/foursquare

So what say you: is the Foursquare-Amex deal going to bring location-based services into everyday shopping vernacular?

Sign up today to have our latest posts delivered straight to your inbox.